A tax can be defined as a fine or penalty. The general purpose of a tax is to raise 1 to fund the operations of the 2.

Progressive Tax Economics Help

It is a tax that imposes a lower tax rate on low-income earners compared to those with a higher income making it based on the taxpayers ability to pay.

. The term progressive refers to the way the tax rate progresses from low to high with the result that a taxpayers average tax rate is less than the persons marginal tax rate. The term progressive describes a distribution effect on income or expenditure referring to the way the rate progresses from low to high where the. Taxes can be distinguished by the effect they have on the distribution of income and wealth.

A progressive tax is characterized by a more than proportional rise in the tax liability relative to the increase in income and a regressive tax is. People who make less than 9950 pay 10 in taxes while people who make more pay a higher rate of tax up to 37. Which statement is correct with respect to marginal and average tax rates under a progressive tax structure.

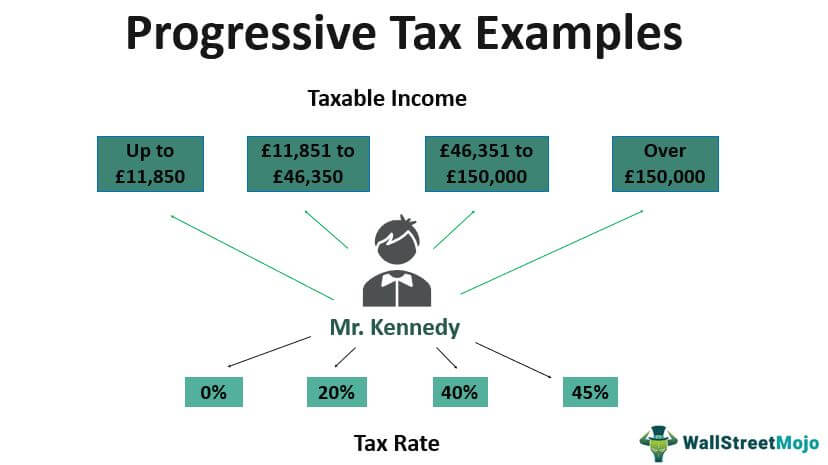

An annual report to the IRS summarizing total income deductions and the taxes withheld by employers. There are several different tax brackets or groupings of taxable income which are taxed at. A progressive tax is a tax which causes the situation that the rich contribute more to the finances of the country than the poor - this means that the more one earns the more one also pays in taxes.

At very low levels of taxable income a taxpayers marginal and average tax rates will be the same. In the US federal income tax is a progressive tax. What Is a Progressive Tax.

All of the following are legislative aspect of taxation except. Income on which tax must be paid. The progressive tax system is a form of taxation in which the tax rate increases as personal income increases.

Under a progressive tax those with more income shoulder more of the tax burden. The term can be applied to individual taxes or to a tax system as a whole. It redistributes income to promote economic growth It is designed to replace a system of sales taxes Question 2 1 point Listen FIGURE.

A progressive tax is based on the taxpayers ability to pay. High-income families pay a disproportionate share of the tax burden. At very high levels of taxable income a taxpayers marginal and average tax rates will be the same.

A tax for which the percentage of income paid in taxes increases as income increases. This problem has been solved. Aspect of taxation which could be delegated.

It imposes a higher rate on the rich than on the poor. Federal taxes are generally _____ while state and local taxes are generally _____. The government accomplishes this through marginal income tax rates meaning you pay a particular percentage of taxes on the part of your income that falls within a certain tax bracket.

Income Tax is thus an example of a progressive tax. It imposes a lower tax rate on low-income earners than on those with a higher income. A progressive tax takes a higher percentage of tax from people with higher incomes.

The United States currently uses a progressive tax system when assigning tax brackets and each bracket is adjusted to reflect changes due to inflation. A progressive tax imposes successively higher rates on taxpayers who have higher incomes. Selection of the object or subject of tax b.

In progressive taxation the tax liability increases with individual or entity income. The tax is levied on people in proportion to the benefit they receive from government programmes A progressive taxation system has larger impacts on the income of poor people than on the income of. Has a progressive tax system.

A regressive tax is one that imposes a harsher burden on lower-income households than on households with higher incomes. The correct answer is. High-income families pay a disproportionate share of the tax burden while low- and middle-income taxpayers shoulder a relatively small tax burden.

It means that the more a person earns the higher his average rate of tax will be. Under this system the lowest income people are generally exempted while the highest income people pay the highest taxes. A progressive tax is a tax in which the tax rate increases as the taxable amount increases.

D A tax that takes a larger share of the income of high-income taxpayers than of low-income taxpayers. A progressive tax is a tax in which the tax rate increases as the taxable base amount increases. Learn about the definition pros and cons and significance of the progressive tax.

In lower-income families a larger proportion of their income pays for shelter food and transportation. Its based on the taxpayers income or wealth. It imposes higher marginal tax rates on higher income.

Her tax liability is currently 4636. It redistributes income from lower income levels to higher income levels. This is based on the principle of ability to pay.

In the 2017 tax cycle those who earned up to 9325 of taxable income were taxed at. Question 1 1 point Listen Which of the following best describes a progressive tax system. Progressive taxation is a legislative policy that takes a greater percentage of a taxpayers income when they earn more money.

A progressive tax is a tax in which the tax rate increases as the taxable amount increases. In this case the person earning 10000 is paying 20 of their income in tax total tax of 2000 The person earning 20000 is paying 30 of their. Function that could be exercised by the executive branch.

Fixing the tax rate to be imposed is best described as a an. Total income minus exemptions and deductions. Arlene is single and has taxable income of 34000.

18 May 2018. C A tax that takes a fixed percentage of income regardless of the taxpayers level of income. A proportional tax is one that imposes the same relative burden on all taxpayersie where tax liability and income grow in equal proportion.

6 December 2017 by Tejvan Pettinger. A progressive tax is one where the average tax burden increases with income. The tax structure is designed according to the ability of the people to pay taxes.

Progressive taxes are imposed in an attempt to. The United States uses a progressive tax for the federal income tax system meaning the more taxable income you have the greater a percentage of that income you pay in taxes.

Progressive Tax Examples Top 4 Practical Examples With Calculation

0 Comments